Using MACD for Effective Trading Strategies

The Moving Average Convergence Divergence (MACD) is an invaluable tool for understanding market trends and momentum. This article explores the fundamentals of MACD, outlining its essential components, including the MACD line and the signal line.

You ll discover various trading strategies, such as the MACD crossover and divergence tactics, along with practical tips for setting parameters and avoiding common pitfalls. Whether you re just starting or are an experienced trader, mastering MACD can greatly enhance your trading effectiveness and decision-making. Jump in now to discover the full power of MACD!

Contents

- Key Takeaways:

- What is MACD and How Does it Work?

- Interpreting MACD Signals

- Different Types of MACD Strategies

- Tips for Using MACD in Trading

- Common Mistakes to Avoid

- Frequently Asked Questions

- What is MACD and how does it work in trading strategies?

- How can I use MACD (Moving Average Convergence Divergence) to identify buy and sell signals?

- Can MACD be used for all types of financial markets?

- What are the key factors to consider when using MACD for trading strategies?

- Are there any limitations to using MACD for trading strategies?

- How can I improve my trading strategies with the use of MACD?

Key Takeaways:

What is MACD and How Does it Work?

The Moving Average Convergence Divergence (MACD) is an exceptional momentum indicator created by Gerald Appel. It helps Forex traders pinpoint potential buy and sell signals derived from historical data.

This versatile tool is a staple in technical analysis, the study of price movements in the market. It effectively evaluates market momentum, facilitating entry and exit points for various strategies, including crossover and zero-cross approaches.

By examining price action alongside moving averages, the MACD provides insights into bullish and bearish momentum, all while monitoring market conditions and volatility.

Interpreting MACD Signals

Interpreting MACD signals accurately is crucial for Forex traders looking to leverage market trends. These signals reveal insights into both bullish and bearish price movements.

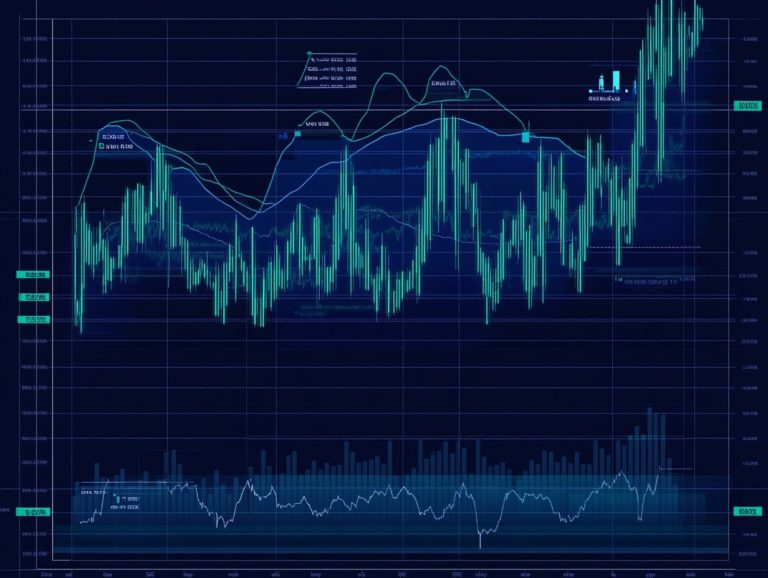

Analyze the MACD line in relation to the signal line to identify potential reversals and make informed trading decisions based on current market conditions. Keep an eye on the MACD histogram to visualize momentum strength, giving you an edge in your trading strategy.

Understanding the MACD Line and Signal Line

The MACD line is a key component of the Moving Average Convergence Divergence indicator. It is calculated by subtracting the 26-period exponential moving average from the 12-period exponential moving average. The signal line, functioning as a 9-period exponential moving average of the MACD line, helps pinpoint entry and exit points in your trading strategy.

Understanding the significance of these lines is critical. They indicate shifts in momentum and potential reversals. A cross above the signal line suggests a buy signal, while a cross below indicates a sell signal. Traders often leverage the divergence between MACD and price action to assess market strength or weakness.

By recognizing these patterns, you can refine your decision-making process and ensure your strategies are based on robust momentum analysis. The MACD s dual role as a momentum and lagging indicator makes it an adaptable tool in technical analysis.

Using Divergence for Trading Decisions

Utilizing divergence in MACD can offer you valuable insights for making informed trading decisions. Divergence occurs when the price movement of an asset contradicts the signals provided by the MACD indicator. This difference can show possible upward or downward trends, which could lead to price reversals.

You can categorize this divergence into two primary types: regular and hidden.

Regular divergence points to an impending price reversal. For example, when the price forms a lower low while the MACD registers a higher low, it suggests a possible bullish turnaround.

On the flip side, hidden divergence signals continuation. This occurs when the price makes a higher high while the MACD displays a lower high, hinting that the current trend may persist.

Incorporating these insights into your trading strategies can significantly enhance your decision-making. This approach helps you act on potential reversals or continuations, ideally timing your entries and exits for optimal profit.

Different Types of MACD Strategies

You can explore several effective trading strategies that incorporate the MACD indicator, such as the crossing strategy, histogram strategy, and divergence strategy. Each of these approaches is crafted to assist you in pinpointing optimal entry and exit points based on market conditions and price action.

By leveraging the unique components of MACD, you can enhance your trading decisions and effectively manage risk.

MACD Crossing Strategy

The MACD crossing strategy is a favored trading method among Forex traders. You’ll seek bullish signals when the MACD line crosses above the signal line and bearish signals when it dips below. This provides you with clear indicators for when to enter and exit trades.

This approach simplifies your decision-making process, turning often complex market movements into straightforward actions.

Many traders enhance these crossings by using additional indicators to bolster the reliability of their signals. Always confirm before acting for the best results!

However, it s essential to remain cautious of market volatility and unpredictable price swings, as these can lead to false signals.

A crossover during a turbulent market can easily mislead you. It is critical to evaluate the overall market context and combine signals to minimize the risk of stepping into losing positions.

MACD Histogram Strategy

The MACD histogram strategy is your go-to method for leveraging the capabilities of the histogram component of the MACD indicator. This tool helps you see clearly how strong the upward and downward trends are, providing visuals of price movements that can guide you in making timely trading decisions.

By meticulously analyzing the bars of the MACD histogram, you can pinpoint critical shifts in market sentiment. Rising bars signal an increase in bullish momentum, while falling bars may indicate an emerging bearish trend.

When the histogram crosses above or below the zero line, it offers a distinct visual cue for potential entry or exit points, allowing you to align your strategies with prevailing trends effectively.

Enhancing your analysis by incorporating trading volume can significantly improve the reliability of these signals. A notable surge in volume accompanying a MACD crossover reinforces the strength of the identified trend, giving you the power to adopt a more informed and confident trading approach.

MACD Divergence Strategy

The MACD divergence strategy is all about identifying divergences between MACD indicators and price action. This enables you, as a Forex trader, to detect potential market reversals and make informed trading decisions based on these insights.

By closely examining the relationship between the MACD line and the price chart, you can identify situations where the price continues to move in one direction while the MACD indicates a shift in the opposite direction. This discrepancy often reveals waning momentum and suggests possible trend reversals.

For instance, if the price is making higher highs while the MACD is charting lower highs, you could be witnessing a bearish divergence. This could signal that it s time to consider potential sell opportunities.

It s essential to confirm these signals with other technical indicators, such as the RSI (Relative Strength Index) or moving averages, to ensure you’re entering trades at a robust point and minimizing your risk.

Tips for Using MACD in Trading

To harness the full potential of MACD in your trading endeavors, prioritize configuring parameters that resonate with your unique trading strategies and the prevailing market conditions.

This approach allows you to accurately identify trends and make well-informed decisions based on the insightful signals provided by the indicator.

Setting Parameters and Identifying Trends

Setting parameters for MACD requires choosing the right periods for the moving averages in its calculation. This choice can greatly influence how responsive the indicator is to price movements and its effectiveness in identifying trends amid varying market volatility.

You should take into account your unique trading style along with the specific characteristics of the asset you re trading to optimize these settings. For example, if you re a trader who makes many quick trades (scalper), you might prefer shorter moving average intervals to seize quick price shifts. On the other hand, if you’re a trader who holds positions for longer periods (position trader), longer intervals could serve you better by smoothing out fluctuations over time.

By fine-tuning your MACD settings, you can enhance signal reliability, significantly boosting your chances of accurately spotting potential reversals or confirmed trends. This is key to making smart, confident trading choices!

Common Mistakes to Avoid

When utilizing the MACD indicator, Forex traders must remain vigilant about common pitfalls that could result in misinterpreting signals or engaging in overtrading. This includes the tendency to rely exclusively on the MACD without considering other technical indicators or the prevailing market conditions.

It’s essential to adopt a more holistic approach to trading to enhance decision-making and optimize outcomes.

Misinterpreting Signals and Overtrading

Misinterpreting MACD signals can lead you down the path of overtrading. You could quickly find yourself frequently entering and exiting positions based on misguided assumptions about market movements an approach that could result in significant losses.

Without a thorough grasp of what these signals truly indicate, you might easily fall prey to misleading trends. This could prompt impulsive actions instead of strategic decisions. This underscores the necessity of validating MACD signals with additional analysis, such as price action or support and resistance levels, to attain a comprehensive understanding of market dynamics.

Adopting a disciplined trading approach can significantly mitigate the risks associated with rash decisions. This allows you to cultivate a balanced perspective that prioritizes thoughtful positions over knee-jerk reactions. By incorporating these practices, you not only safeguard your capital but also enhance your overall trading effectiveness.

Frequently Asked Questions

What is MACD and how does it work in trading strategies?

MACD, or Moving Average Convergence Divergence, is a technical analysis indicator used to identify potential trend changes and momentum shifts in financial markets. It works by comparing two moving averages, typically a shorter and longer period, to determine the strength and direction of a trend.

How can I use MACD (Moving Average Convergence Divergence) to identify buy and sell signals?

When using MACD for trading strategies, a common approach is to look for crossovers between the MACD line and its signal line. A bullish crossover, where the MACD line crosses above the signal line, can be seen as a buy signal. Conversely, a bearish crossover, where the MACD line crosses below the signal line, can be seen as a sell signal.

Can MACD be used for all types of financial markets?

Yes, MACD can be applied to a wide range of financial markets such as stocks, forex, commodities, and cryptocurrencies. Its versatility allows it to be used across various time frames and chart types, making it suitable for different trading strategies.

What are the key factors to consider when using MACD for trading strategies?

Consider the overall trend, its strength, and support and resistance levels. Combine MACD with other indicators and always manage your risk properly.

Are there any limitations to using MACD for trading strategies?

MACD is not foolproof and should not be your sole basis for trading decisions. Constantly monitor market conditions and adjust your strategies accordingly. MACD can give false signals in choppy or range-bound markets, so it’s crucial to consider the overall market context.

How can I improve my trading strategies with the use of MACD?

One way to enhance your trading strategies is to combine MACD with other technical indicators, such as trend lines, support and resistance levels, and volume analysis. This approach provides a more comprehensive view of the market and increases the likelihood of making profitable trades. Continuously analyze and adjust your strategies based on performance and market conditions.

Start using MACD today to enhance your trading strategies and spot those profitable opportunities!